A data company

with a difference

Making aviation

information intelligent

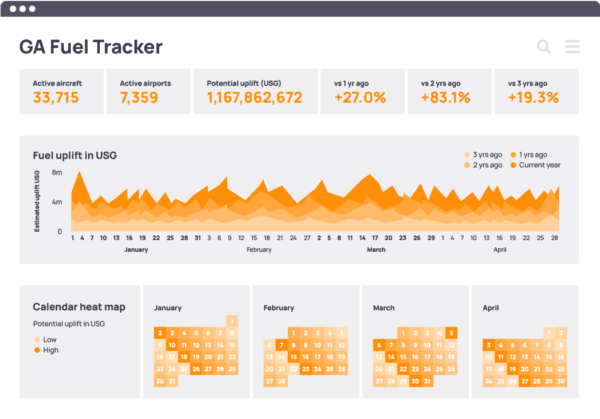

Every minute of every day WINGX collects information on flight activity, giving you the tools to find where aircraft is located, its exact position, its altitude, speed and engine thrust. Discover a flight’s origin and destination, distance travelled, fuel expended and emissions output. You can even track airframe type, model and equipment profile.